Private Jet Insurance Australia: What Charter Clients Must Know

Flying private is a statement of both comfort and trust. But beyond the plush seats and exclusive terminals, what truly delivers peace of mind is knowing you’re fully protected. That’s where private jet insurance Australia steps in. Whether you’re chartering a jet for business, leisure, or a special family event, understanding how charter flight insurance works can make all the difference. What exactly does private jet insurance cover for Australian charter clients, and what should you look out for before signing the dotted line?

Quick Answer:

Private jet insurance in Australia covers charter clients for liabilities, passenger safety, and property damage. Policies may include coverage for medical emergencies, third-party liabilities, and damage to the aircraft, ensuring peace of mind throughout your charter flight.

What Is Private Jet Insurance in Australia and Why Is It Essential?

Private jet insurance Australia is a tailored policy designed to protect both jet owners and charter clients from unexpected events. Unlike regular travel insurance, it encompasses everything from passenger safety to liability for accidents or damage during a chartered flight. For Australians chartering jets, it’s an extra assurance that both you and your assets are secure in the skies and on the ground.

Key Differences Between Private Jet Insurance and Travel Insurance

- Travel insurance covers the individual traveller, while private jet insurance Australia focuses on the flight, aircraft, crew, and all parties involved.

- Charter flight insurance Australia may include liability coverage, aircraft damage, and medical costs specific to private aviation, not just general trip cancellation or baggage loss.

- Understanding these differences helps clients choose the right level of protection.

Why Charter Clients Need Liability Insurance for Charter Flights

- Liability insurance for charter clients protects against claims arising from injury, property damage, or third-party loss during a flight.

- If an incident occurs, the policy shields the passenger from legal and financial consequences, offering confidence to both first-time and repeat charterers.

- Most reputable Australian charter operators provide this insurance as standard but always verify coverage specifics.

What Does Private Jet Insurance Cover for Charter Flights in Australia?

One of the top questions from first-time and seasoned clients alike is: what does private jet insurance cover? The answer can vary, but several core protections are usually standard for charter flights in Australia.

Standard Inclusions in Charter Flight Insurance Australia

- Aircraft hull and property damage

- Passenger liability, including injury or death

- Third-party legal liabilities

- Emergency medical expenses and repatriation

Optional Extras: Are You Fully Covered?

- Some charter operators offer additional policies, such as cover for high-value goods, sporting equipment, or international travel requirements.

- Upgrading your charter flight insurance Australia may be wise for business groups, celebrities, or families with special needs.

- Always ask your broker to detail optional extras and exclusions before you fly.

The Claims Process: What Happens If There’s an Incident?

- Immediate reporting and documentation are essential for a smooth claim.

- Work with your charter operator and their insurer to understand steps, timelines, and required paperwork.

- Many reputable companies in Australia, like GoJets, provide a client liaison to help manage the claims process with minimal stress.

How Much Does Private Jet Insurance Cost for Charter Clients in Australia?

The cost of private jet insurance Australia for charter clients depends on several factors, including aircraft type, route, passenger profile, and additional cover requirements.

Main Factors Affecting Charter Flight Insurance Australia Premiums

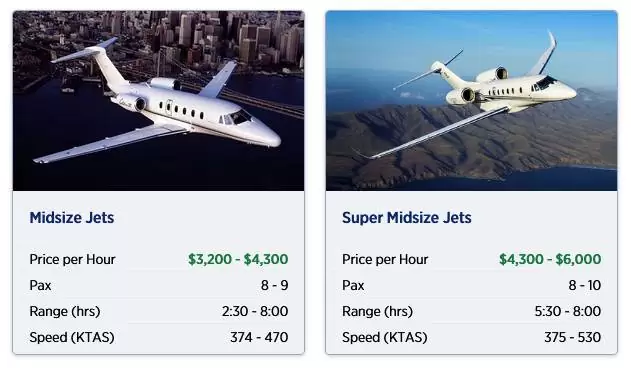

- Aircraft value and category (light jet, midsize, heavy jet)

- Flight route and whether it’s domestic or international

- Number of passengers, their profiles (VIP, high-risk, etc.), and length of coverage

Can Charter Clients Reduce Their Insurance Costs?

- Choosing reputable operators with strong safety records can help lower premiums.

- Avoid unnecessary extras unless needed for your specific situation.

- Consider annual policies for frequent flyers instead of per-trip insurance for cost efficiency.

Comparing Charter Flight Insurance vs. Owner Insurance

- Charter clients are typically covered under the operator’s policy; however, owners often need broader coverage for aircraft downtime, crew, and more.

- For clients considering frequent or fractional ownership, understanding both types of coverage is essential for full peace of mind.

How to Make Sure You’re Properly Covered When Booking a Charter Jet

Navigating the complexities of private jet insurance Australia can seem daunting, but a little preparation goes a long way.

Questions to Ask Your Charter Operator or Broker

- Is charter flight insurance Australia included in my booking? What are the limits?

- What does private jet insurance cover for my itinerary, and are there any exclusions?

- Can I get a copy of the policy wording before confirming my flight?

Working With GoJets for Complete Charter Protection

- GoJets partners only with fully licensed, CASA-compliant operators to guarantee complete liability insurance for all clients.

- Our charter specialists review your itinerary and recommend any optional extras based on your unique needs.

- We’re on hand for advice, fast answers, and 24/7 support – from first enquiry to post-flight peace of mind.

FAQ: Private Jet Insurance Australia for Charter Clients

Do I Need My Own Insurance When Chartering a Private Jet?

Most Australian charter operators provide comprehensive insurance for all passengers. However, review the terms and consider additional cover for valuables or unique risks.

What’s the Difference Between Private Jet and Charter Flight Insurance?

Charter flight insurance Australia specifically covers risks related to the aircraft, passengers, and third parties during a booked charter flight, whereas owner insurance is for long-term operators and aircraft owners.

How Can I Make a Claim If Something Goes Wrong?

Contact your charter operator or broker immediately, gather all relevant documentation, and follow the process outlined in your policy. GoJets assists clients with claims for a smooth experience.

Are There Legal Requirements for Private Jet Insurance in Australia?

Yes, under CASA and Australian aviation law, all charter operators must hold minimum levels of liability insurance for passengers and third parties.

Author profile:

Written by Sarah Williams – Aviation Insurance Specialist at

GoJets, 12+ years’ experience in private jet insurance, trusted advisor for high-net-worth Australian travellers.